Geometric sequences are heavily involved in the financial industry. We all want to be financially stable and secure so we can enjoy ourselves. As we get older, it is natural to start thinking about retirement. At some point, we will ask ourselves, “Can I retire at age $70$ and live comfortably?”. Everyone’s circumstances are different but it is never too early to start planning for retirement. There are many financial investment companies that want your business. In other words, they want your money. They advertise that if you give them your money now, you will get it back in $1$ year, $5$ years, $10$ years, etc. As a reward for your generosity, you will get your money back plus $2\%$ interest, $4\%$ interest, or maybe $8\%$ interest. In this chapter, we will explore one of the basic financial tools banks used to lure customers. Savings accounts which involve a term length, compounding period, and an interest rate.

The future value $\rm(FV)$ of a savings account can be determined based on many factors such as the present value $\rm (PV)$, interest rate $(r)$, compounding period $(k)$, and length of time $(t)$ the money is left in the account. The compounding period is how often interest is computed and deposited back into the account. This will be $k=1$ (annually), $k=2$ (semi-annually), $k=4$ (quarterly), or $k=12$ (monthly). The time $t$, will always be in years. The interest rate $r$ will always be a percentage.

The formula for the future value of an account is given by:

$\rm FV=PV\left(1+\dfrac{r}{100k}\right)^{kt}$

The TI-84 CE graphing calculator has a financial applications calculator built into it which will be very useful to answer problems.

Example: John opens a savings account at the local bank. The bank offers him $3.5\%$ interest, compounded semi-annually. If John makes an initial deposit of $€10~000$, makes no further deposits, and leaves the money in the account for $12$ years, determine the future value of the account to the nearest Euro.

Explanation: Using the formula for a savings account gives:

$\rm FV=10~000\left(1+\dfrac{3.5}{100(2)}\right)^{(2)(12)}$

$\rm FV=10~000(1.0175)^{24}$

$\rm FV=10~000(1.51644279)$

$\rm FV=15 164$

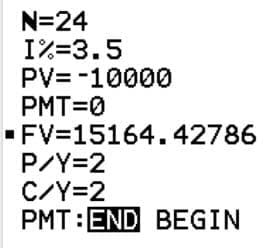

Using the TVM Solver on the graphing calculator under the apps button gives:

Notice that $\bf N$ is the total number of compounded periods, $\rm i.e.$ $2$ times a year for $12$ years. $\bf PV$ is a negative number because John is temporarily parting ways with the money. $\bf P/Y$ and $\bf C/Y$ are the number of compounding periods per year. To determine the $\bf FV$ we must use the solve command by pressing alpha and then enter.

Nouveau ! Découvrez Nomad'IA : le savoir de nos 400 profs + la magie de l'IA

Nouveau ! Découvrez Nomad'IA : le savoir de nos 400 profs + la magie de l'IA